In this edition: $18.5 billion in annual contract value up for renewal in 2022. HCM provider recovering from ransomware attack. Irish bank extends relationship with IBM. Private equity continues to invest in IT services.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

RENEWALS, INCUMBENCY AND 2022

It’s been a whirlwind year for the IT services industry. Managed services bookings are up 17% YTD, and as-a-service ACV is up a whopping 33%. And we’ve easily surpassed the record for number of managed services acquisitions in a single year at 143.

Recall that, in 2Q20, ACV was down 17%. Spending has come roaring back since then as companies across every industry accelerate their digital transformation. The IT services industry, in particular, delivered in a big way by helping clients stabilize during the worst of the pandemic.

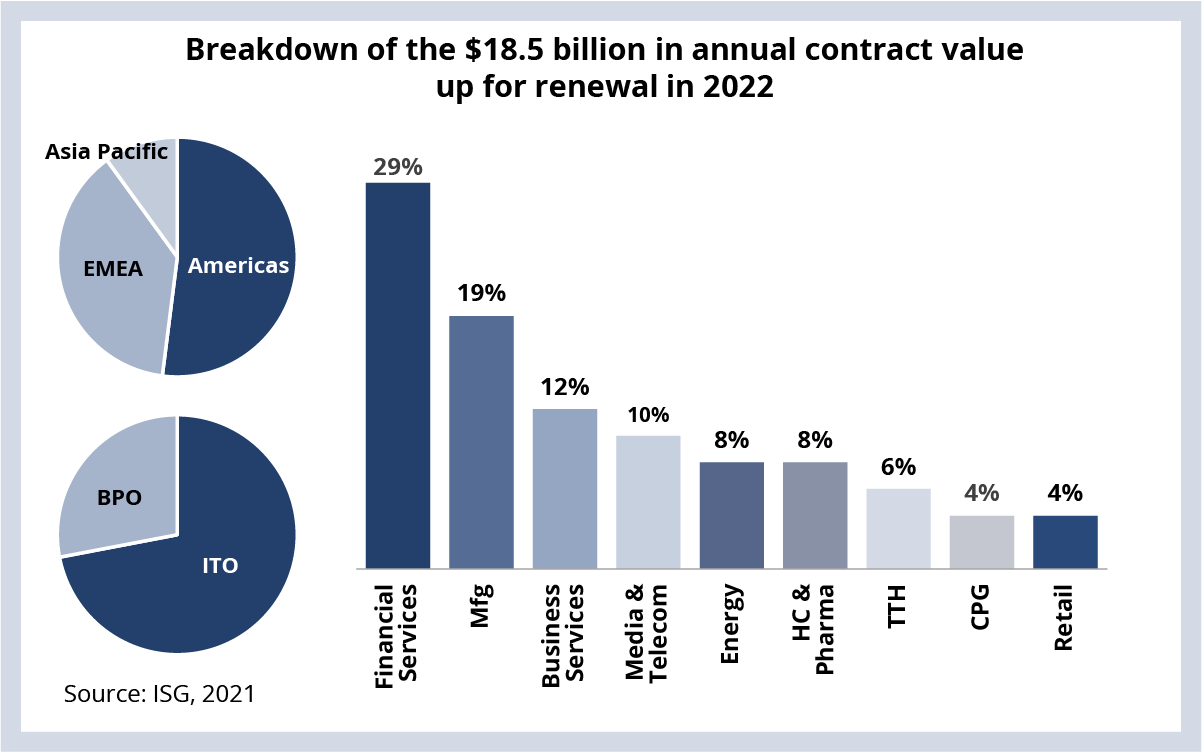

Now let’s turn to 2022. There is $18.5 billion in annual contract value up for renewal next year. Nearly three quarters of the renewals will come from ITO awards and 28% from BPO awards. A little more than half of the ACV will come from the Americas, 38% from EMEA and 10% from Asia Pacific. And nearly a third of the ACV will come from the financial services industry (see Data Watch).

We’re keeping a close eye on these renewals because of a new pattern we’ve seen emerge this year: enterprises are doubling down on incumbents. In other words, companies are inviting providers with whom they already have MSAs to bid on new scope. This has had an impact in 2021 and could have a significant impact on who wins – and who loses – these renewals in 2022.

We hope you can join us to recap this unprecedented year and to review our 2022 outlook on the 4Q21 ISG Index call on January 10, hosted by Bryan Bergin, Managing Director at Cowen. Register here.

DATA WATCH

CYBERSECURITY

Impacted applications are offline as a result of the incident. The outage directly impacts the time-and-payroll operations for multiple public and private employers, including leading retailers and government organizations. The incident may take at least a few weeks to resolve.

UKG confirmed it continues to communicate and work closely with its customers and is deploying all available options to support them during the outage, including leveraging backup data from time clocks, processing time and pay files from prior periods and using other manual workarounds. UKG is also publishing updates here to keep clients informed as new information becomes available.

For updates on UKG and the HCM market, you can follow Pete on Twitter @PeteT_ISG.

DEAL ACTIVITY

- AIB and IBM. Irish bank extends existing relationship with a three-year $73 million award (link).

- Asahi Europe & International and Tech Mahindra. Asahi Group company signs five-year infrastructure and applications modernization agreement (link).

- Etihad and Kyndryl. UAE airline signs three-year hybrid cloud agreement (link).

- Orion Corporation and Infosys. Finnish pharmaceutical company modernizing ERP (link).

- Centers for Medicare and Medicaid Services and CGI. U.S. federal agency signs five-year $44 million renewal focused on cloud modernization (link).

M&A ACTIVITY

- Private equity firm Kedaara acquires GAVS Technologies (link).

- Unisys acquires CompuGain (link).

- Infosys acquiring Malaysian delivery center from Singtel (link).

- EPAM acquiring media-focused product engineering firm Optiva Media (link).

- Accenture acquiring French network services firm AFD TECH (link).

- Wipro acquiring Infor systems integrator LeanSwift (link).

- Infogain acquires product development firm NNT (link).

- Equinix expands into Africa with acquisition of data center provider MainOne (link).